The real costs of making money

Download the WEA commentaries issue ›

Where and how was the silver or gold used to produce historical coins mined, who produced at what (human) costs and who owned the mines?

Summary. Is money ‘neutral’ in the sense that it only eases transactions without really influencing them or without changing society? To answer this question the production of gold and silver used to make some historical kinds of money is investigated – a kind of product ‘life cycle analysis’. It turns out that production often happened at appalling human costs, that mines were often owned by the government. Mining and minting enabled states to expand and flourish, while the production itself profoundly changed local communicates and sometimes even entire nations. In these senses, money was far from neutral.

- Introduction.

This article applies a roughshod and incomplete ‘life cycle analysis’ or ‘from cradle to grave analysis’ to some historical kinds monies: the piece of eight, the Roman denarius, the Athenian Owl, the (probably) rings of silver used to buy Joseph as well as the bars of gold which were central to the ‘gold standard’ system. It does this to show ‘the other side of these coins’. Popular economic discourse about the origin of money often presupposes an idealized market economy based on barter which gradually starts to develop and use silver or gold coins for market transactions, as this enables traders to lower transaction costs and to circumvent ‘the double coincidence of wants’. Based upon imperfect knowledge of monetary history it often sees a gold and/or silver based monetary system or a system very akin to this as ideal.1 At this moment this idea even reverberates in the present USA presidential elections as especially conservative wannabees tout the idea of the gold standard. Look here. This ‘markets lead to money’ idea, long prevalent in many economic treatises, has been given renewed scientific credibility by Karl Brunner and Alan Meltzer (1971) who stated that using money is, theoretically, consistent with optimizing in a world with imperfect information and transaction costs. Without the coins and in the guise of the idea of the ‘classical dichotomy’, which states that in the long run money does not influence the ‘real’ economy, this idea can still be found in economic textbooks: money is neutral in the sense that it enables but does not influence market transactions while it exists to do exactly this (for an oversight: Desan, 2013)REF?. The ‘markets lead to money’ idea is, like the idea of the ‘neutrality’ of money, clearly quite influential in popular as well as scientific discourse.

The historical record is not kind to such ideas (among many others: Desan, 2013). Restricting ourselves to coins (which surely were not the first kind of money) it is clear that governments and not markets have been pivotal in the development of coins and coinage from the very beginning, in Lydia around 630 BC and markets (especially long distant markets) were outright slow to embrace the invention, despite government subsidies. To quote a recent article of Jacques Melitz (2015): ‘Minting small change was a big, expensive problem in the ancient world. This column argues that the ancient Lydian government and Greek city-states absorbed the cost of producing an extremely wide array of denominations of coins as a political strategy. Governments had much to gain from the spread of coinage in managing budgetary affairs … A proper analogy would be the interest that contemporary governments have to encourage popular reliance on computers, at public expense, in order to induce online declarations of taxes’. Melitz, who did look at the historical record, clearly is of the opinion that governments played a crucial role in the development of coins, though he surely does not dismiss the existence of markets and the use of gold and silver in trade in those days! And governments used coins to their benefit, as we will see. This article emphasizes this by looking in western culture at iconic kinds of money mentioned above and investigates the (organization of) systematic mining of gold and silver used to make this money. It asks the questions how and where the silver or gold used to produce state money was produced, who owned the mines, how mining was organized and who mined the gold and at what (human) costs. This will show that, time and again, the state played a pivotal role while mining enabled empires to flourish but happened at appalling human costs.2 Money was produced at a high price. First, we’ll investigate this for the (probably) rings of silver used to buy Joseph.

A personal note: reading up on this brought me from the mountains of Peru to the deserts of Egypt and the mountains of south Africa, from lead in Greenland ice cores to slag heaps in Spain and from ancient texts to recent statements of presidential candidates in the USA. Quite a trip.

- Selling Joseph

‘So when the Midianite merchants came by, his brothers pulled Joseph up out of the cistern and sold him for twenty shekels of silver to the Ishmaelites, who took him to Egypt.’ Genesis 37:28

The sting in the tail of the story: it seems that the regular price for a slave in this period was thirty shekels of silver. Joseph was probably sold below market value. But our question is: where did this silver come from? Who mined it? At which costs? Who owned the mines? It is important to note that these shekels were not coins. At this time the ‘shekel’ still was an official weight which related to a fixed amount of barley (i.e. a ‘grain standard’ of the unit of account, see p. 10 of this study by Jon Bosak, accessed 20 December 2015) and ‘a shekel of silver’ was not a coin but an amount of silver (look here, p. 770, for all biblical examples of this). It would take another 1,000 years before a king in this area started to mint coins, which bore his sign. But: where did the silver come from? According to this site, it came from, among other regions, the Sinai and the deserts of Egypt, it was mined by convicted criminals and prisoners of war as well as (mines where often cramped) pretty young children, mining happened at appalling human cost and was organized by the Egyptian state. According to Diodorus Siculus (Library of History Vol 1, Chap. 3.12): “The Egyptian kings send those condemned for a crime and the prisoners of war, among them many who succumbed to a false accusation, and not only these themselves but sometimes all their relatives as well, to labour in the gold mines; and by punishing the condemned in this way they have great income from their labour. The number of those condemned to this work is very great; and their feet are all fettered and they all have to work incessantly, not only by day but also through the night, for no rest is permitted them and they are deprived of all possibility of escape, as guards soldiers of a barbaric tribe are stationed there who speak a completely different language, and nobody can bribe a guard by heart-rending supplication or persuasion”.

Output quota were set by officials, who were sent by the government. This is consistent with the findings of Hirt, 2010, who investigated all available scriptural sources on Roman mining. More details can be found here.

- The Athenian owl

“The Divine Bounty has bestowed upon us inexhaustible mines of silver, and advantages which we enjoy above all our neighbouring cities, who never yet could discover one vein of silver ore in all their dominions.”

Xenophon

Picture 1. The ‘Athenian owl’, the standard money minted by Athens

How did Athens manage to become that rich and powerful? Money creation and slave labour: 10,000 to 20,000 slaves were working in the silver mines at Laurium. It was this wealth which, famously, enabled them to build the fleet which beat the Persians. Mind that Themistocles persuaded the Athenians, in 480 BC, to use the anticipated revenue from the new vein discovered in 482 BC, to build this fleet. About these mines an excerpt from ‘The classics pages’ by Andrew Wilson:

The Silver Mines

Athens was the only Greek polis (city-state) with the ability to dig its own wealth straight from the ground. Laurion was an area near the east coast of Attica rich in silver-bearing ores which had been exploited since the Bronze Age. In 482 BC a new vein was discovered which led to a massive increase in activity.

The Scale of Operations

There were about 350 mines producing 1000 talents a year, worked by 10-20,000 slaves. Mining rights were owned by polis, but leased to individuals by 10 annually elected poletai. The purity of the silver (which was protected by law) led to Attic “owls” being widely respected. They have been found as far afield as India and Algeria.

Workforce

All were slaves. Numbers were large: Thucydides mentions 20,000 deserting to Decelea (encouraged by the Spartans to put economic pressure on Athens). Factories were designed to minimise risks of slaves getting hold of silver. “Trusty” slaves were given incentives (own houses). Slaves would be owned by wealthy Athenians … and hired out to the lessees of the mines. They were usually prisoners-of-war, not criminals. Their life expectancy was short and they lived and worked in conditions of indescribable squalor.

- The Roman Denarius

“Render to Caesar the things that are Caesar’s, and to God the things that are God’s”

Matthew 22:21

There is more to the famous Jesus quote above than meets the eye. He stated this after the Pharisees had shown him, on his request and after they had asked him if they should pay Roman taxes, a denarius: Roman money. In the Jewish temple priests were not allowed to use this ‘heathen’ money (hence the money changers in the temple). And Jesus reframes the discussion from a political to a spiritual one by showing that the Pharisees did own and use such unholy, imperial money. But enough preaching. Our questions are where the silver used to make the denarius came from, who owned the mines and who produced it. The answers are: it came to an large extent from the Rio Tinto mines in southern Spain which were owned by the Roman state and, while we do know how it was produced in a technical sense, we do not really know how production was organized (though the ‘ad metallum’, working in the mines till death, was a standard penalty for minor crimes).

The Roman empire was quite late to start minting coins (third century BC). It might have been (opinions differ) that until that time they lacked a dependable inflow of silver. In 226 BC the first silver denarius was struck. Not long after the minting of this first denarius the Romans gained, during the second Punic war (218-201 BC) control over Iberia, i.e. Portugal and Spain (205 BC), which gave them access to the all-important and already ancient Rio Tinto mines. These mines were in ancient times mined by the indigenous population, later by the Carthaginians and eventually by the Romans. The Romans had a knack for effectively applying existing technology to large scale projects. In this case ventilations shafts and drainage systems were built to enable deep vein mining (up to 200 metres) which enabled a considerable expansion of the Rio Tinto production of silver and lead (lead was a necessary as well as valued by-product and also used in the process to extract silver).

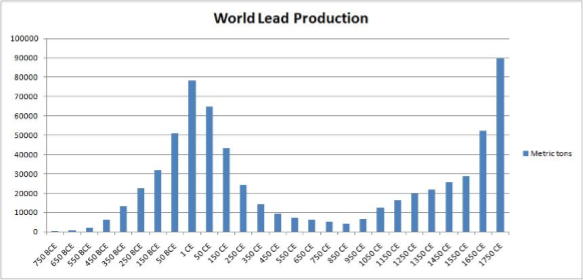

We know that Rio Tinto was the main source of silver in the Roman empire as (based on lead in Greenland ice cores): ‘Lead with a Rio Tinto-type signature represents ∼70% of the lead found in Greenland ice between ∼150 B.C. and 50 A.D.’ (Rosman et al., 1997). According to this information, Roman production of metals was indeed impressive – it would take until about 1750 until its level of production of lead was surpassed.

Picture 2. World lead production

Source: this Wikipedia page assessed 18 December 2015, original source here.

According to Barry Yeoman: “The scale of mining at Rio Tinto fundamentally altered the Roman economy… Rome used silver denarii to pay and feed its army, fund public building programs in its capital city, and subsidize the price of (and eventually allow free distribution of) grain to the city’s residents.” The discontinuation of silver production seems to have disrupted the monetary system. The decline of production of lead aligns with the decline of the silver content of Roman coins. At the end of the second century, the Roman empire lost access to the mines (because of an invasion by the North-African Mauri) and the silver content of the denarius, which around 15 BC had been 97%, dropped according to the precise estimates of Alan Pense (Provost of Leigh University in Bethlehem) after the year 170 from 80% to 60% while after about 250 it suddenly plunged to 2%, leading to some vehement ‘bad money drives out good money’ dynamics.

The Rio Tinto mines were owned by the Roman state and managed by a procurator (or sometimes a sub-procurator) who was directly appointed by the emperor and not responsible to the governor of Spain. We do not really know how labour in the Rio Tinto mines was organized. Roman writers were unanimous that work in the mines was gruelling here. Tacitus even ranks it as one of the reasons for conquered people to revolt. Circumstances in the shafts (which could run up to 200 meters deep) must often have been appalling: cramped, hot, moist and pitch dark except for some oil lamps. We also do not really know who worked in the mines. I could not find any mention of the number of people working in or around the mines and A.J.M. Jones states on p. 838 of Jones (1964): ‘The organization of mining is most obscure’. Since Jones wrote some progress has been made but the picture still is as far as I could gauge far from clear. Evan Haley (1991) investigates all known tombstone inscriptions and the like in Spain which enable us to investigate where somebody who had deceased was born and finds (though he is not able to quantify this) that there was considerable interregional migration tied to mining locations, while it is also possible that entire villages were removed to mining sites by the Romans and points to the possible existence of purely male villages near mines which probably housed seasonal workers. The archaeometallurgist Anguilano (2012) investigated the slag heaps of the Rio Tinto mines to investigate what these tell us about the organization of work, her work contains a ‘state of the art’ overview of what we know about the organization of mining in Rio Tinto. The process was surely state led in the sense that the state granted concessions, took care of basic infrastructure and took its cut. It also seems that encompassing processes, like drainage, were state organized. Alfred Michael Hirt (2010) has published an exhaustive overview of all known literary sources about Roman mining (including tombstones and the like). He too describes a process which, depending on geological and geographical circumstances, in the end was state led but which made extensive use of small and large subcontractors and, depending on circumstances, different kinds of free and coerced labour while occasionally army personal was used in the mines. We have to keep in mind that the different stages of the process (digging, transporting the ore, crushing the ore, smelting) may have been organized in different ways and Anguilano suggests that the mines first were worked by slaves, later (when the wars of conquest came to a halt and new slaves became scarce) by families of miners and even later by the state who, using a simpler technology and less experienced workers, adapted to population declines caused by outbreaks of plagues as well as to dwindling resources of wood and charcoal. Also, as stated, the ad metallum, being sent to the mines, was a common sentence for petty criminals.

- The piece of eight

‘African slaves were also forced to work in the Casa de la Moneda (mint) as acémilas humanas (human mules). Since mules would die after a couple of months pushing the mills,the colonists replaced the four mules with twenty African slaves’

Source: Wikipedia

The piece of eight was in the seventeenth and eighteenth century the currency of choice of the global Habsburg empire, it financed much of the wars waged by this empire and also squelched a considerable part of the persistent European and South American seventeenth and eighteenth century trade deficits with China (which had a silver standard). The continuous imports of these coins and other kinds of silver from South America by Spain were not just a boon in their own right but also a very important collateral for Habsburg borrowing (Goodwin, 2015). It is even likely that the global role of this silver coin led to an upward pressure on the price of silver in general (aside from the downward pressure caused by the high production of silver), therewith increasing the profits of silver mining and coinage.3 We ask the questions: where did this silver come from? Who owned the mines? Who mined it and how? The answers to these questions are clear. The silver largely came from the silver veins of the Cerro Ricco, the ‘rich mountain’, in Peru. Or, as the silver workers named it, ‘la montana que como hombres’, ‘the mountain that eats men’. It was owned by the Habsburg empire while concessions were leased to local Spanish entrepreneurs. In 1545 the town of Potosi was founded next to the Cerro Ricco. In 1672 its population had increased to about 200.000 which means that it was, remote and at 4,000 meters of altitude, about as large as Amsterdam, the commercial capital of the western world at that time. In Peru, the silver was not mined by the Spanish colonists inhabiting this city but by indigenous workers and slaves as well as African slaves. The costs were high. Native laborers were set to work using the traditional Incan ‘mita’ system of contributed labour (ironically: a non-monetary system of division of labour). Many of them died due to the harsh conditions of the mine life. According to Noble David Cook, “A key factor in understanding the impact of the Potosi mita on the Indians is that mita labor was only one form of work at the mines. A 1603 report stated that of 58,800 indians working at Potosi, 5100 were mitayos, or less than one in ten. In addition to the mitayos there were 10,500 mingas (contractual workers) and 43,200 free wage earners. Yet mitayos were required to do the work others refused: predominantly the transport of the ore up the shafts to the mouth of the mine… ” (Cook, 1981, p. 237). On p. 238 Cook quotes Rodrigo de Loaisa who stated in 1586: “If twenty healthy Indians enter on Monday, half may emerge crippled on Saturday”. To compensate for the diminishing indigenous labor force, in 1608 the colonists made a request to the Crown in Madrid to allow the importation of 1,500 to 2,000 African slaves per year. An estimated total of 30,000 African slaves were taken to Potosí during the colonial era. Modern day miners in Potosi often still die young, from silicosis.

- South African gold and the Gold Standard

By 1914, South-Africa was the world’s top producer of gold (detailed data in Katzen, 1964). The increase of, mainly, South African gold production is supposed to have ended the 1873-1896 gold deflation, which indicates that its monetary role was crucial. But who produced this gold and at what price? Who owned the mines? What kind of labour system was used? The gold was produced by cheap black migrant flexworkers from, initially, all over Southern Africa, as the Cape Colony (2.5 million inhabitants in 1900) and the South African Republic (1.4 million inhabitants in 1900) were far too small to supply enough labour. These black workers were supervised by white workers which were about one tenth of the total work force and who earned about ten times as much per person as the black workers. The number of black labourers rose from about 14,000 around 1890 to around 100,000 in 1900, almost 300,000 in 1939 to a 480,000 all-time high in 1986. Labour continued to be cheap and Katzen (1964) shows that mines preferred labour shortages over raising the black wage and also worked together to control the supply of labour. Especially after 1970 labour increasingly came from South Africa alone (Harington, McGlashan, and Chelkowska (2004).). The mines were privately owned but ownership sometimes is a tricky concept. De Boer had not long before defeated African kingdoms and taken much of the land, while the South-African war between de Boer and the British was all about control of the gold fields. Also, using a well-known strategy, black Africans were obliged to pay monetary taxes to draw them into the orbit of the monetary economy, among other reasons to enable a steady supply of cheap labour (the disastrous cattle plague of 1896-1897 also contributed to this). The ‘hegemon country’ of the time, Great Britain, adhered to the gold standard which meant that it had an interest in keeping the price of gold low relative to other prices. After 1912, however, gold output in south Africa was basically stable which meant that it could not keep up with a rapidly growing world economy, which might have contributed to the deflationary tensions which led Great Britain to leave the gold standard in 1931 (Katzen, 1964, pp. 18-19).

The short and long-term social and economic consequences of the system of migrant labour were not benign, the Apartheid system can be understood as a conscious effort to use a migrant labour system to extract rent and surplus value. Below, some long excerpts about this from: Harington, McGlashan, and Chelkowska (2004). By the way: only when the migrant labour system broke down, during and after the 1899-1902 war and mines had to close, black wages doubled despite the discontinuation of much mining… remember this when reading the excerpts:

Labour practices followed the existing migratory pattern for domestic and foreign labour in industry, a pattern which exists to this day. Gold miners, like diamond miners, were accommodated in compounds, often segregated by ethnic group, and contracted for 18-month stints with no certainty of reengagement. The source areas of these miners have for the whole of the twentieth century fallen into three political categories: men from within the borders of South Africa itself, including former black ‘homelands’; men recruited from the former High Commission, now independent territories, Botswana, Lesotho and Swaziland, Mozambique and from as far afield as Angola, Zambia, and Tanzania.. The data all support the contention that the migrant system is untenable, pervasive and regrettable, certainly not a temporary system, but an entrenched and fundamental one with serious social costs. It has become a permanent feature of life for millions of workers … In 1890 the number employed was 14 000. By the end of that decade this number had increased sevenfold and by 1998 the total stood at 255 000, a drop of 42 per cent from its peak of 534 000 in 1986

. …. By 1932 South Africa and its highly cost-sensitive gold mining industry were enjoying a windfall. In that year the country departed from the Gold Standard, new gold-bearing formations were found, and the gold price rose. These windfalls gave industry perhaps its greatest boost ever and ‘seven golden years’ of expansion followed. Black employment increased as a result, reaching a new peak of over 360 000 in 1939–40. … The peak of mining operations and its labour fell away from 1941 and stayed depressed until the mid-1950s. … South Africa’s market policy in 1973 contributed much to the rapid rise of the gold price to above US$100 an ounce. … Between 1985 and 2000, the value of mine output had increased by more than 250 per cent, whereas employment had fallen by 50 per cent …

Conclusion. States have, always and everywhere, played an important monetary role and clearly used mining and minting to finance expansion and the organization of the state and the use of coins probably enabled them to do this more efficiently and effectively. Mining often happened at appalling human costs and in most cases by forced labour, while it also gave rise to the growth of entire, large, cities and decisively influenced nature of states and societies. To be able to do this, these states were dependent on a steady inflow of silver or gold which enabled them to create money and to borrow more – mines where therefore often owned (though often not exploited) by the government. Eventually, markets would embrace coins and coin based systems of credit, but this is alas outside the scope of this article.

Literature (articles and books, blogposts, Wikipedia pages and the likes are linked in the text)

Anguilano, L. (2012). Roman lead silver smelting at Rio Tinto. The case study of Corta Lago. London: University College London.

Brunner, K. and A. H. Melzer (1971). ‘The uses of money: money in the theory of an exchange economy’, The American Economic Review 61-5 pp. 784-805

Goodwin, R. (2015). Spain. The centre of the world 1519-1682. London: Bloomsbury.

Haley, E.W. (1997), Migration and economy in Roman Imperial Spain. Barcelona: Universidat de Barcelona

Harington J.S., N.D. McGlashan and E.Z. Chelkowska (2004). ‘A century of migrant labour in the gold mines of South Africa‘, The Journal of the South African Institute of Mining and Metallurgy March 2004 pp. 65-71.

Hirt, A. M. (2010). Imperial mines and quarries in the Roan world. Organizational aspects 27 BC – 235 AD. Oxford: oxford University press

Jones, A.H.L. (1964). The later Roman empire 280-604. Part II.A social, economic and administrative survey. Baltimore: John Hopkins University Press.

Melitz, J. (2015), ‘The profitability of early coinage’, Voxeu 10 October 2015, http://www.voxeu.org/article/profitability-early-coinage

Noble David Cook (1981). Demographic collapse. Indian Peru 1520-1620. Cambridge: Cambridge University Press.

Rosman, K.J.R. e.a. (1997): ‘Lead from Carthaginian and Roman Spanish Mines Isotopically Identified in Greenland Ice Dated from 600 B.C. to 300 A.D.’, Environmental science & technology 31-12 pp. 3413-3416

_______________________________________________

- The ‘double coincidence of wants’ is the problem that in a barter economy the producer of, say, milk who wants to trade this for, say, clothing needs to find a person making clothes who wants milk. In real life, this problem is often solved by providing credit or, in non-monetary societies, by a division of labour based upon kin, position in the family, feudal dues and whatever.

- The ecological costs of mining will not be investigated.

- This is of course not seigniorage or an ‘inflation tax’ but I do not know an apt phrase for this. Might something like the ‘coinage bounty’ do?

From: pp.9-14 of World Economics Association Newsletter 5(6), December 2015

https://www.worldeconomicsassociation.org/files/Issue5-6.pdf

Fascinating article.

Many years ago, in pre-digital times, I purchased from a thrift store some old 8mm movies that turned out to be 1920’s vacation films made by some anonymous tourist that included footage of a South Africa visit. These showed black males — almost certainly gold or diamond mine workers — all dressed the same in loose black and white vertically striped uniforms, like prisoners. I can’t claim to have the appropriate historical knowledge, but I’m guessing that not only were those workers horribly oppressed economically; they also were actual physical prisoners of their workplaces.