NAFTA Renegotiation: An alternative approach to foster upward economic convergence

Download the WEA commentaries issue ›

By Robert A. Blecker, Juan Carlos Moreno-Brid and Isabel Salat

[Editor’s Note: This is a shortened version of a paper that will be published in December 2017 in the Real-World Economics Review.]

Affiliations: Robert A. Blecker – Department of Economics, American University; Juan Carlos Moreno-Brid—Facultad de Economía, UNAM; and Isabel Salat— Facultad de Economía, UNAM.

The election of Donald Trump as US president has put the future of the North American Free Trade Agreement (NAFTA), as well as US-Mexican relations generally, back onto the political agenda. The political success of Trump’s demagoguery (and faux populism) partly reflects the failures of the neo-liberal policy regime in place since the Reagan era (for example, adjustment costs that were not offset, industrial policies that were not adopted, inequality that grew out of control, and a dollar that was allowed to become overvalued). The aftermath of the 2007-08 financial crisis has not produced a hopeful outlook for many Americans. Even though the rising inequality was not caused solely by the subprime crisis and the downturn that followed – it had been building up over the past three decades – the crisis made matters worse, to the point where it could no longer be ignored (Stiglitz, 2015)

Indeed, globalization and regional integration have not worked well for most Americans and Mexicans. Recent research shows that the US has experienced significant localized job market effects (mostly depressed wages and dislocation of less educated workers) as a result of NAFTA’s tariff reductions (Hakobyan and McLaren, 2016), as well as much larger job losses attributed to increased imports from China and worsened inequality attributed in part to trade and outsourcing more generally (see Autor et al., 2016; Bivens, 2017).

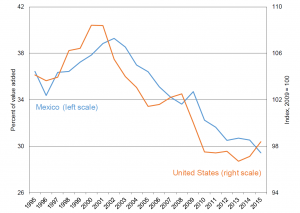

In both countries, real wages have failed to keep up with rising productivity of labor in key tradable goods industries, especially manufacturing, resulting in falling shares of wages in national income at least since the late 1990s (see Figure 1; see also Mishel et al., 2012; Ibarra and Ros, 2017). Moreover, the Mexican economy has made no progress in convergence with the US in per capita income or wages since NAFTA went into effect in 1994.

Figure 1. Private business sector labor shares, Mexico and United States, 1995-2015

Sources: Ibarra and Ros (2017), data used with permission; U.S. Bureau of Labor Statistics (BLS), www.bls.gov; and authors’ calculations.

The great paradox about NAFTA

NAFTA appears to have been successful in its immediate objectives of promoting greater volumes of trade and flows of foreign investment. Regional trade increased sharply over the agreement’s first two decades, from roughly $290 billion in 1993 to more than $1.1 trillion in 2016. Inflows of foreign direct investment (FDI) into Mexico have also increased since NAFTA went into effect in 1994, from an average of 1.2% of Mexico’s GDP in 1980–1993 to 2.7% of GDP in 1994–2016.

However, recent research finds that only part of the post-NAFTA increase in regional trade can be attributed to the causal impact of the tariff reductions in this trade agreement. Romalis (2007) estimated that the tariff reductions in NAFTA increased bilateral US-Mexican trade by only 23%, while Caliendo and Parro (2015) – using a model that emphasizes trade in intermediate goods – estimated that the impact was to slightly more than double US-Mexican trade. These are not negligible increases, but they suggest that US-Mexican trade has grown for many reasons besides NAFTA. In any event, bilateral Mexican-US trade has clearly become very important for both countries: as of 2016, the Mexican economy was the third largest supplier of goods imports into the US, and the second most important destination (after Canada) for US exports, while the US was by far Mexico’s largest trading partner accounting for about 80% of its exports and 50% of its imports.

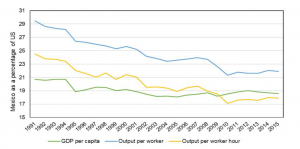

In spite of the increases in trade and FDI, however, the larger goals that the Mexican government proclaimed for NAFTA when it was adopted in 1994 have not been achieved. Contrary to the assertion by then-president Carlos Salinas de Gortari that NAFTA would transform Mexico into a “first-world country,” there has been no convergence between Mexico and the US in per capita income or labor productivity since NAFTA went into effect (see Figure 2). Indeed, Mexico has suffered from a disconnect from the promises of some of NAFTA’s supporters that the pact would deliver rapid growth, raise wages, and reduce emigration. Between 1993 and 2013, Mexico’s economy grew at an average annual rate of just 1.3 percent, during a period when most of Latin America was undergoing a major expansion. In spite of the increase in FDI as a percentage of GDP, there is no evidence that the ratio of domestic investment to GDP has increased in Mexico in the post-NAFTA era.

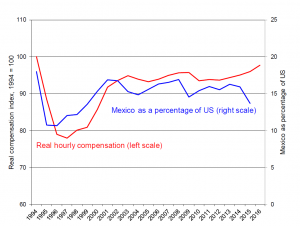

Poverty in Mexico remains at about the same levels as in 1994. Also, the expected “wage convergence” between US and Mexican wages never occurred. As Figure 3 shows, as of 2016, real hourly compensation in Mexican manufacturing was still below its absolute level from 1994, while as of 2015 (the last year for which comparable data are available) Mexican hourly compensation was also a lower percentage of the US level than in 1994. Furthermore, Mexico’s per capita income rose at an average annual rate of just 1.2% in the 1993-2013 period – far slower than in other Latin American countries such as Brazil, Chile, and Peru (McBride & Aly, 2017).

Figure 2. GDP per capita and labor productivity in Mexico as a percentage of US, 1991-2015

Sources: Data from World Bank, World Development Indicators, and OECD Statistics, accessed October 15, 2017, and authors’ calculations.

Figure 3. Hourly compensation of Mexican production workers, in real terms and as a percentage of the US, 1994–2016

Sources: Authors’ calculations based on data from Banco de México, www.banxico.org.mx; INEGI, EMIM, www.inegi.org.mx/; BLS, International Labor Comparisons, www.bls.gov; accessed 26 June, 2017 and earlier; and Conference Board, https://www.conference-board.org/ilcprogram/, accessed 9 August, 2017.

This brings us to the great paradox about NAFTA and Mexico. On the one hand, NAFTA and related policies of trade liberalization and neo-liberal reforms adopted since the late 1980s have been an abject failure from a development standpoint: after three decades, these policies have never achieved the promised convergence to first-world (US) levels of real wages or per capita incomes or any progress in that direction. On the other hand, NAFTA (in combination with those same related policies) has locked Mexico onto a growth trajectory along which whatever growth does occur – however slow and inadequate – derives most of its momentum from the performance of exports, and hence is highly dependent on the growth of the US market and other external factors (Blecker, 2009).

As a result, any changes to NAFTA that would impede Mexican exports would undermine the chief dynamic factor in the Mexican economy, and a US withdrawal from NAFTA or the imposition of higher tariffs and other trade barriers could be catastrophic in the short and medium term. Yet, the failure of the current development model implies that Mexico needs to re-think its economic strategy anyway, and ironically the threats from Trump could provide an opportunity to accelerate that re-thinking and shift Mexico’s policy paradigm to a more development-oriented, less externally dependent, and more equitable and sustainable model.

The road ahead: towards a new agenda of development and shared prosperity

Mexico has an urgent need for a new development agenda based on strengthening the internal market (equality + structural transformation + fiscal reform). This is true and will remain true independently of any outcome of the NAFTA renegotiation. To the extent that the renegotiation is based on a Trumpian view of trade as a zero-sum game, the outcome will not favor Mexico’s development prospects.

The US also needs a new policy regime to reverse rising inequality, secular stagnation, and regional divergences. The Trump negotiating agenda for NAFTA would do little if anything to achieve this. Protection could potentially benefit particular industries or areas, but would not reverse the national trends and could worsen competitiveness in other, unprotected sectors (and even some of the protected ones, such as automobiles, if their costs rise). In the extreme case that Trump would withdraw the US from NAFTA, important US export sectors such as corn farming and agricultural equipment could lose substantially from higher Mexican tariffs. However, a revised NAFTA that promotes industrial growth and competitiveness throughout North America could help the US along with other measures. A progressive response to Trump must address concerns of US workers over disappearing jobs and stagnant wages, or it will be a political non-starter. Raising incomes and wages in Mexico as well as legalizing undocumented immigrants and enabling them to obtain higher wages are win-win policies for US and Mexican workers.

In the past few decades, what has made the impact of globalization and regional trade agreements more painful than necessary in both countries is the fact that they have occurred in an environment in which adequate safety nets are not in place, full employment is not guaranteed, and the likely earnings from alternative employment (for example, in the service sector instead of manufacturing, especially informal activities in Mexico) are often much lower than in the occupations lost due to trade or offshoring. Governments supporting trade agreements and integration projects have been reluctant to admit the severity of the potential adjustment costs, lest they lose support for their liberalization efforts – even though such efforts at denial are not only intellectually unjustified (even in theory, trade generally creates losers as well as winners), but also have often backfired politically (as in the success of the Trump and Brexit campaigns).

Moreover, all this is occurring in an era (since roughly the 1980s) when macroeconomic policies (especially monetary policy) have shifted in many countries (including Mexico and to a lesser extent also the US) toward a greater focus on price stability and balanced budgets than on full employment and economic growth. Mexican growth during the entire neo-liberal era (since the late 1980s) has been less than half as rapid as it was during the import substitution era (1940s-70s), while US employment growth has slowed down notably since the US began to experience “secular stagnation” in the early 2000s (Blecker and Esquivel 2013; Blecker 2016).

Thanks in part to the US Great Recession and slow growth since 2008 and in part to Trump’s threat to withdraw from NAFTA, today the external market has stalled as an engine of expansion for Mexico. There is thus an urgent need to implement a new agenda of development in Mexico based on strengthening the domestic market, in the context of an open economy. The new agenda has three main priorities: i) income redistribution to tackle inequality; ii) structural transformation to, in particular, strengthen backward and forward linkages of the productive sector; and iii) much more active state intervention in the economy.

In that sense, addressing industrial policies, financial policies, regional policies, and public investment with the aim of strengthening backward and forward linkages of the productive sectors and including the export sector, promoting backward regions and boosting infrastructure are essential to transform the process of North American integration to one of “upward convergence” (defined as a process in which Mexico approaches US levels of wages and per capita income, but with those levels continuing to rise in the US and not being pulled down). The idea is not to disregard export capacities, but rather to supplement them with a strong impulse from the domestic market.

In order to achieve more inclusive and sustainable growth in both Mexico and the US, given their current degree of integration and the changing character of global production and technology, we believe that is neccesary to devise economic policies that can move the two neighbors back to such a trajectory of upward convergence, on which real wages would increase in line with productivity growth in both countries.

Policy actions with a long-run perspective

In this endeavor, we propose some policy guidelines. First, as inequality has became a constraint for growth on both countries, tax policies for income redistribution can be an alternative. For the US, the best approach would be to restore high marginal tax rates on very high incomes and inherited wealth, which would help to reverse the heightened inequality that the US has experienced since the 1980s (Mishel et al., 2012).

In Mexico, a fiscal reform is urgently needed to bolster Mexican government tax revenue in a progressive way. This would provide funding for infrastructure investment and social expenditures, strengthen the state’s capacity to implement countercyclical policies, and put in place a much more transparent and efficient system of public investment across the nation aligned with the priorities of the National Development Plan.

Second, public investment and industrial policies are needed to reduce the tremendous infrastructure “deficits” in Mexico and the US, as a result of inadequate and declining public resources being invested in public capital in recent decades. A massive increase in infrastructure spending in both countries would boost demand and employment in the short run, while augmenting capacity and productivity in the long run.

Third, to promote upward economic convergence by pulling up wages and living standards at the bottom end of the income scale while also putting upward pressure on median wages it is essential to raise the minimum wage in both countries. It should be noted that for decades, in Mexico, minimum wages have not followed the evolution of productivity. If minimum wages had been linked to market conditions and the performance of their own efficiency, those salaries would have seen a path of rise, not of deterioration.

Increasing minimum wages in the context of a full commitment to give a more relevant role to the state in promoting a less unequal functional distribution of income is key to reducing the unacceptably high levels of inequality and poverty in Mexico. However, many Mexicans have been understandably reluctant to press for wage increases in response to the demands of the Trump administration, which seem aimed only at reducing Mexico’s competitive advantages. Of course, minimum wages do not generally apply in most export industries, but by setting a floor under the entire wage structure, they can influence other wages as well. That is why it is also important to also raise the minimum wage in the US at the same time as it is increased in Mexico, so that there is little or no net competitive impact and instead there is simply a redistribution of income toward lower-paid workers in both countries.

Finally, to promote a new agenda of development in the US and Mexico, what are most important are macro-level policies that can boost demand, augment supply capacity, and ensure full employment. By “macro-level,” we mean not only traditional fiscal and monetary policies, but also other types of measures that are economy-wide and can have a national impact on the bargaining power of workers in labor markets and competitiveness in external markets. And we do stress that increasing productive capacity is essential in order to prevent inflationary outcomes (especially in the Mexican context), which means that any fiscal stimulus should focus heavily on capacity-enhancing measures such as infrastructure, education, and innovation.

In this regard, placing inequality at the center of economic policy concerns is a central requirement for Mexico, as is successfully responding to Donald Trump’s threats, in order to escape the slow-growth trap in which Mexico is currently stuck, thereby reducing social vulnerabilities and political instability in the long term. At the same time, we hope that the US will reverse the trend toward nationalism, xenophobia, and isolationism that has emerged under the Trump administration, and will turn instead to a more cooperative approach to fostering upward convergence of Mexico within North America as well as a return to more progressive social and economic policies at home. In all of this, the renegotiation of NAFTA can play at most a small part, if it is done with a cooperative, win-win spirit; whereas a nationalistic rewrite of NAFTA or a hasty US withdrawal from it would only complicate the task of making North American integration work more in the interest of average US and Mexican citizens.

References

Autor, D. H., Dorn, D. & Gordon, H. H., 2016. The China shock: Learning from labor-market adjustment to large changes in trade. Annual Review of Economics, Issue 8, pp. 205-240.

Bivens, J., 2017. Adding insult to injury: How bad policy decisions have amplified globalization’s costs for American workers, Washington: Economic Policy Institute.

Blecker, R. A., 2009. External shocks, structural change, and economic growth in Mexico, 1979-2007. World Development, 37(7), pp. 1274-1284.

Blecker, R. A., 2016. The US economy since the crisis: Slow recovery and secular stagnation. European Journal of Economics and Economic Policies: Intervention, 13(2), pp. 203-214.

Blecker, R. A. & Esquivel, G., 2013. Trade and the development gap. In: A. Selee & P. Smith, edits. Mexico and the United States: The Politics of Partnership. Boulder. Colorado: Lynne Rienner, pp. 83-110

Blecker, R.A. & Moreno-Brid, J.C. & Salat, I. (2017). “Trumping the NAFTA Renegotiation: An Alternative Policy Framework for Mexican-US Cooperation and Economic Convergence”, Real World Economic Review, WEA, forthcoming. December.

Caliendo, L. & Parro, F., 2015. Estimates of trade and welfare effects of NAFTA. Review of Economic Studies, 82(1), pp. 1-44.

Hakobyan, S. & John, M., 2016. Looking for Local Labor Market Effects of NAFTA. Review of Economics and Statistics , 98(4), pp. 728-741.

Ibarra, C. A. & Ros, J., 2017. The decline of the labor share in Mexico, 1990-2015. Mexico City, International Economics Association World Congress.

McBride, J. & Aly, M., 2017. NAFTA’s Economic Impact, New York: Council on Foreign Relations.

Mishel, L., Bernstein, J. & Shierholz, H., 2012. State of Working America 2008/2009. 12th edition ed. New York City: Economic Policy Institute.

Moreno-Brid, J.C., Ruiz Napoles, P. & Rivas Valdivia, J.C. , (2005), “NAFTA and the Mexican Economy: A Look Back on a Ten-Year Relationship”, North

Carolina Journal of International Law and Commercial Regulation, Vol 30, 4, Summer.

Puchet, M. & Punzo, L. edits., 2011. Mexico Beyond NAFTA: Perspectives for the European Debate. New York: Routledge Studies in Development Economics.

Ruiz, Nápoles, P., 2017. Donald Trump, NAFTA and Mexico. Voices of Mexico, Issue 103, pp. 19-23.

Stiglitz, J., 2015. El precio de la desigualdad. Barcelona: Penguin House Grupo Editorial.

From: pp.2-6 of WEA Commentaries 7(5), October 2017

https://www.worldeconomicsassociation.org/files/Issue7-5.pdf